Business Insurance in and around Seguin

One of the top small business insurance companies in Seguin, and beyond.

Almost 100 years of helping small businesses

Your Search For Remarkable Small Business Insurance Ends Now.

When you're a business owner, there's so much to take into account. We get it. State Farm agent JB Servise is a business owner, too. Let JB Servise help you make sure that your business is properly protected. You won't regret it!

One of the top small business insurance companies in Seguin, and beyond.

Almost 100 years of helping small businesses

Keep Your Business Secure

Did you know that State Farm has been helping small businesses grow since 1935? Business owners like you have turned to State Farm for coverage from countless industries. It doesn't matter if you are a dentist or an insurance agent or you own a music school or a vet hospital. Whatever your business, State Farm might help cover it with personalized policies that meet each owner's specific needs. It all starts with State Farm agent JB Servise. JB Servise is the agent who understands where you are firsthand because all State Farm agents are business owners themselves. Contact a State Farm agent to gather more information about your small business insurance options

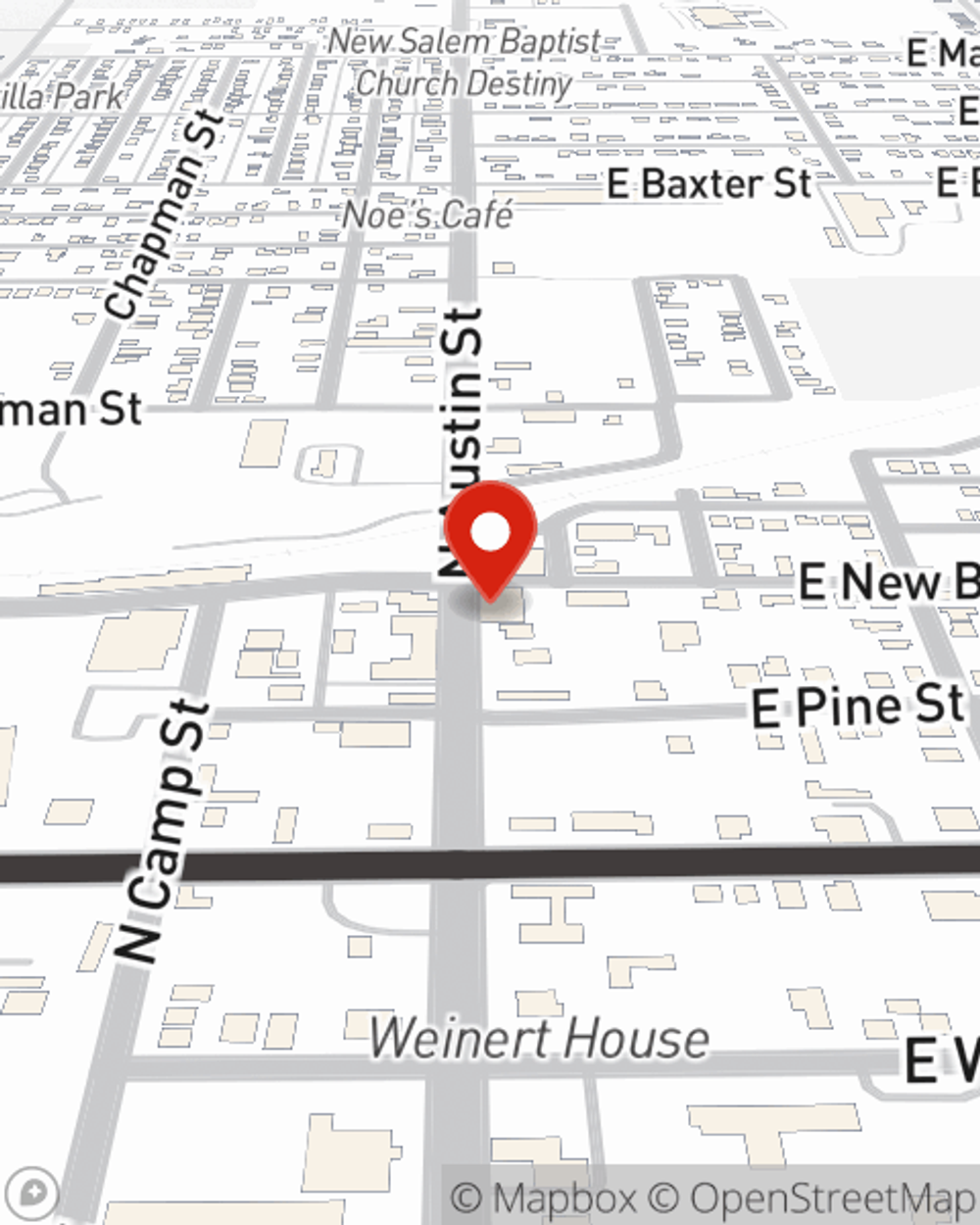

Contact State Farm agent JB Servise today to see how one of the leaders in small business insurance can ease your business worries here in Seguin, TX.

Simple Insights®

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

JB Servise

State Farm® Insurance AgentSimple Insights®

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.